These tax benefits can significantly reduce the regular tax of some. It applies to taxpayers who have certain types of income that receive favorable treatment or who qualify for certain deductions under the tax law.

Https Www Irs Gov Pub Irs Utl 03 Alternative 20minimum 20tax 20pains Pdf

State and Local Income Tax Refunds from Years Prior to 2017.

2018 alternative minimum tax worksheet. The standard deduction is not allowed when calculating the alternative minimum tax AMT. The AMT applies to taxpayers who have certain types of income that receive favorable treatment or who qualify for certain deductions under the tax law. Similarly AMT NOL is defined as deductions defined by alternative minimum tax.

Instead enter on the Federal Carryover Worksheet. By checking this box I elect under section 172b3 of the IRC to forego the carryback period. If you are required to pay Minnesota alternative minimum tax you must include this schedule and a copy of federal Form 6251 when you file your Form M1.

By checking this box I elect under section 172b3 of the IRC to forego the carryback period. Also see Line 3 later for more information about how these credits impact your alternative minimum tax. Get thousands of teacher-crafted activities that sync up with the school year.

Alternative Minimum Tax Worksheet for NOL Purposes. Combine lines 1 and 20. Use IRS Form 6251 as a worksheet and review the discussion on AMT in the online version of this article.

If you paid Minnesota alternative minimum tax in one or more years from 1989 through 2017 you should com-plete Schedule M1MTC to see if you are eligible for a credit. If line 21 is zero or a positive number you do not have an AMT-NOL. Any of your alternative minimum tax AMT.

Alternative Minimum Tax Calculator for 2017 2018 Published November 19 2017 Alternative minimum tax is automatically imposed on a taxpayer earning beyond a threshold. If you did not complete either worksheet for the regular tax enter the amount from Form 1040 or 1040-SR line 15. Property for which the corporation elected to use the alternative depreciation system ADS for the regular tax.

Combine lines 1 and 20. If the individual is OVER age 18 at the end of 2018 and NOT a full-time student and their earned income IS over half of their support then they would appropriately check this. Click Continue to the screen AMT - Under Age 24 Status for Exemption where you can check the box if applicable.

Prior Year Alternative Minimum Tax. This is your alternative minimum tax net operating loss AMT-NOL 21_____ Caution. Attach to Form 1040 or Form 1040NR.

This tax worksheet calculates Alternative minimum taxs net operating loss deduction. You can calculate this amount using the worksheets in Internal. Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet whichever applies as figured for the regular tax.

These tax benefits can significantly reduce the regular tax of some taxpayers with higher economic incomes. Get thousands of teacher-crafted activities that sync up with the school year. Alternative Minimum TaxIndividuals Go to wwwirsgovForm6251 for instructions and the latest information.

If you did not pay Minnesota alter-native minimum tax in any year from 1989 through 2017 do not ile Schedule. Part I Alternative Minimum Taxable Income. A net operating loss NOL is defined as a taxpayers excess deductions over a taxpayers gross income.

See each credit form for more information. Alternative minimum tax for 2018. 2018 Schedule M1MT Alternative Minimum Tax.

Names shown on Form 1040 or Form 1040NR. If you received a state or local income tax refund for years prior to 2017 during 2018 you will need to determine what portion if any of that refund is taxable. Click Taxes in the Federal Quick Q.

Any qualified property eligible for a special depreciation allowance if the depreciable basis of the property for the. 2018 Tax Forecasting Worksheet a. Your First Name and Initial Last Name Social Security Number Round amounts to the nearest whole dollar.

Ad The most comprehensive library of free printable worksheets digital games for kids. Your social security number. Senior Head of Household Worksheet.

The AMT is a separate tax that is imposed in addition to your regular tax. If line 21 is zero or a positive number you do not have an AMT-NOL. If you are eligible for either of these credits in 2018 you can claim it on your 2018 return.

Depreciated for the regular tax using the 150 declining balance method or the straight line method. Ad The most comprehensive library of free printable worksheets digital games for kids. This is your alternative minimum tax net operating loss AMT-NOL 21_____ Caution.

Enter zero on line 29. If zero or less enter -0-. Use Form 6251 to figure the amount if any of your alternative minimum tax AMT.

1116 Frequently Asked Questions 1116 K1

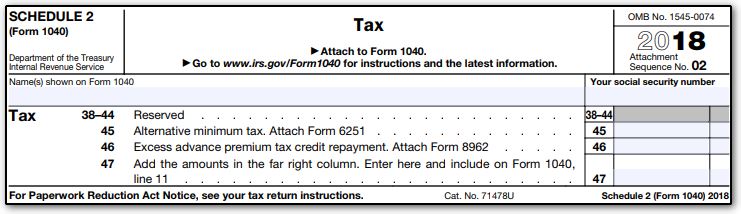

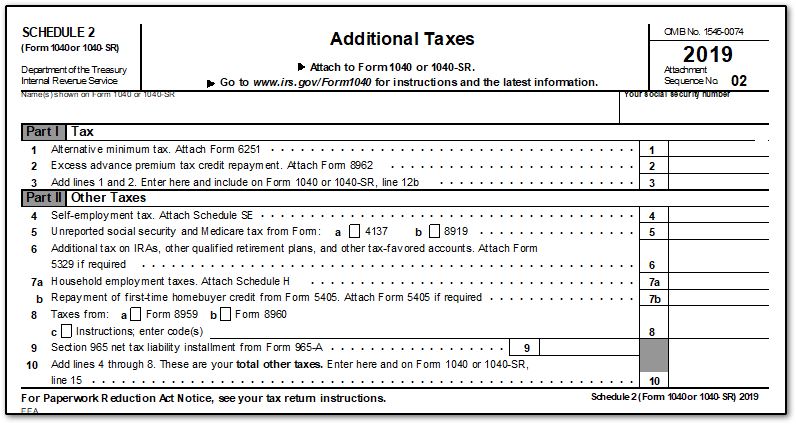

1040 Schedule 2 Drake18 And Drake19 Schedule2

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

Form 6251 Alternative Minimum Tax Individuals Definition

Irs Schedule 2 Will You Owe Extra Tax The Motley Fool

Irs Releases New 2018 W 4 Form Cpa Practice Advisor

Instructions For Form 8995 A 2020 Internal Revenue Service

The 2018 Form 1040 How It Looks What It Means For You The Pastor S Wallet

Instructions For Form 1040 Nr 2020 Internal Revenue Service

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

What Is Alternative Minimum Tax Amt Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Pin By How To Dominate Local Markets On Carolacarlson Tax Lawyer Legal Marketing Income Tax

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Irs Schedule 2 Will You Owe Extra Tax The Motley Fool

1040 Schedule 2 Drake18 And Drake19 Schedule2

The 2018 Form 1040 How It Looks What It Means For You The Pastor S Wallet

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

Form 6251 Alternative Minimum Tax Individuals Definition

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

0 comments:

Post a Comment